Introduction:-

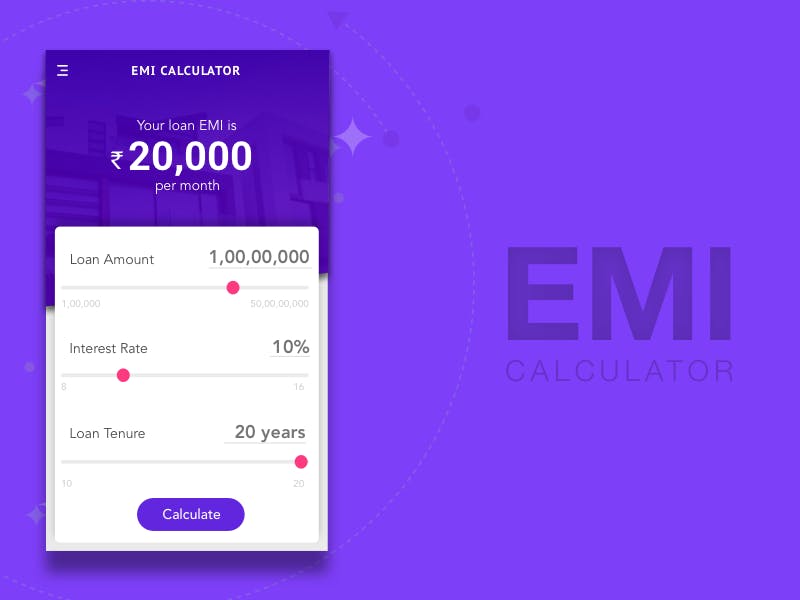

There are lots of calculators designed to help people with their finances, but relatively few are explicitly geared towards small businesses. That's changing, though, thanks to a new EMI Calculator app. This app is designed to help businesses better understand their borrowing options and what costs they're likely to incur. It considers the interest rate, the loan term, and the company's credit score.

1. What is an EMI calculator?

An EMI calculator is a helpful tool for businesses seeking a business loan. This EMI calculator helps to determine the effective monthly interest rate and the total interest cost over the loan term. This EMI calculator can also calculate how much principal will be repaid on the loan and the repayment terms. By using an EMI calculator, businesses can better understand their borrowing options and make informed decisions about which type of loan is best for them.

2. How does an EMI calculator work?

An electromagnetic interference calculator or EMI calculator is app businesses and loan officers use to assess potential EMI issues with a proposed business loan.

EMI stands for electric, magnetic and electronic interference. It can occur when two or more devices are close to each other, causing their signals to interfere. This can cause problems with communication, data processing, and even equipment performance.

A Business Loan EMI calculator will help identify any potential EMIs that may need to be accounted for when deciding whether to grant a loan. By doing this, lenders can ensure that their loans are safe and compliant with regulatory requirements.

3. Why is an EMI calculator necessary for business loans?

An EMI calculator is an essential app for business loans, and it allows lenders to see how much money a business will need to borrow and how much interest the business will be paying. This information is crucial for businesses looking to borrow money, as it can help them make informed decisions about which loan option is best for them.

EMI calculators also play an essential role in preventing fraud. By understanding how much interest a business will be paying, lenders can identify any fraudulent behavior early on and take appropriate steps to stop it from happening.

4. How can businesses use an EMI calculator?

The use of an EMI calculator can help businesses get a better understanding of what their EMI would be for a business loan. This information can help ensure that the company is getting the best possible deal on their borrowing, as well as helping to avoid costly mistakes.

An EMI calculator can also determine how much debt a certain amount of income would allow a business to take on. This is important because it lets companies know how much money they need to bring in each month to qualify for financing.

By using an EMI calculator, businesses can save time and money when looking for financing options.

5. What are the benefits of using an EMI calculator?

There are many benefits to using an EMI calculator when securing a business loan. First, the calculator will help determine the actual cost of borrowing money based on an EMIs associated with the loan. It can also help identify potential issues with the loan terms before signing anything. Additionally, using an EMI calculator can save time and money by ensuring that all possible costs associated with a business loan are considered.

An EMI calculator can be beneficial in verifying the financial health of a business. An accurate picture of a company's actual liabilities can be seen by calculating the total cost of ownership and including an EMI fee. Additionally, an EMI calculator can calculate the interest rate on a business loan and determine if refinancing is necessary.

6. Are there any drawbacks to using an EMI calculator?

There are a few potential drawbacks to using an EMI calculator when looking to secure a business loan. First and foremost, the accuracy of these tools can be questioned, mainly if the calculation is based on an outdated or incomplete data set. Additionally, EMI calculators typically require the input of specific financial data that may not always be available in a company's records, which can result in inaccurate results. Finally, because EMI calculations often require significant time and effort, businesses that need funding quickly may find these tools insufficient.

There can be many drawbacks to using an EMI calculator when trying to get a business loan. For example, the calculator may not consider important factors such as the company's credit score. Additionally, the calculator may not estimate how much money the company will need for a given loan size.

7. What factors should businesses consider when using an EMI calculator?

When looking to secure a business loan, businesses should consider using an EMI calculator. This tool can help businesses calculate the amount of money they will need to borrow and the associated interest rates. Additionally, businesses should factor in the cost of EMI and whether or not they will be able to afford it. If the business cannot repay its loan on time, it could face significant consequences. By using an EMI calculator, businesses can ensure that they are getting accurate information about their borrowing options.

When considering whether or not to use an EMI calculator for a business loan, businesses should consider the following factors:

- The type of EMI calculator used. There are different calculators, each with its features and limitations.

- The specific needs of the business. For example, if the business is in the technology industry, it may need specific calculations related to equipment frequency response and power transfer capabilities.

- The financial stability of the business.

- The size and complexity of the loan being contemplated.

- Any unique concerns concerning the equipment or loan being considered for purchase or financing.

- The availability and cost of finance options available to the business.

conclusion

In conclusion, if you're looking to secure a business loan, use an EMI calculator. They can help you understand your total borrowing costs and give you a more accurate estimate of your monthly repayments. Additionally, an EMI calculator can help save you time and money by identifying potential errors in your original loan application.